The 6 Principles of the Dow Jones Theory

The Dow Theory is a trading concept conceived by Charles H. Dow, an American journalist and founder of the ‘Dow Jones & Company financial firm. The ‘Jones’ part refers to the statistician and co-founder of the company who also took part in the development of Charles Dow’s concepts. Initially, it consisted of 255 editorials. Dow himself didn’t actually create and name the theory. After Dow’s death, Rea, Schaefer, and Hamilton gathered the editorials, formed the theory and named it after Dow.

Even though it’s more than 100 years old, this is the theory that technical analysts use and swear by today.

The 6 Principles Of The Dow Jones Theory:

1) The market action discounts everything

The idea that the markets reflect every possible knowable factor that affects overall supply and demand is on the basic premises of technical theory.

The theory applies to market averages, as well as it does to individual markets, and even makes allowances for "Acts of God." While the markets cannot anticipate events such as earthquakes and various natural calamities, they quickly discount such occurrences, and almost instantaneously assimilate their effects into the price action.

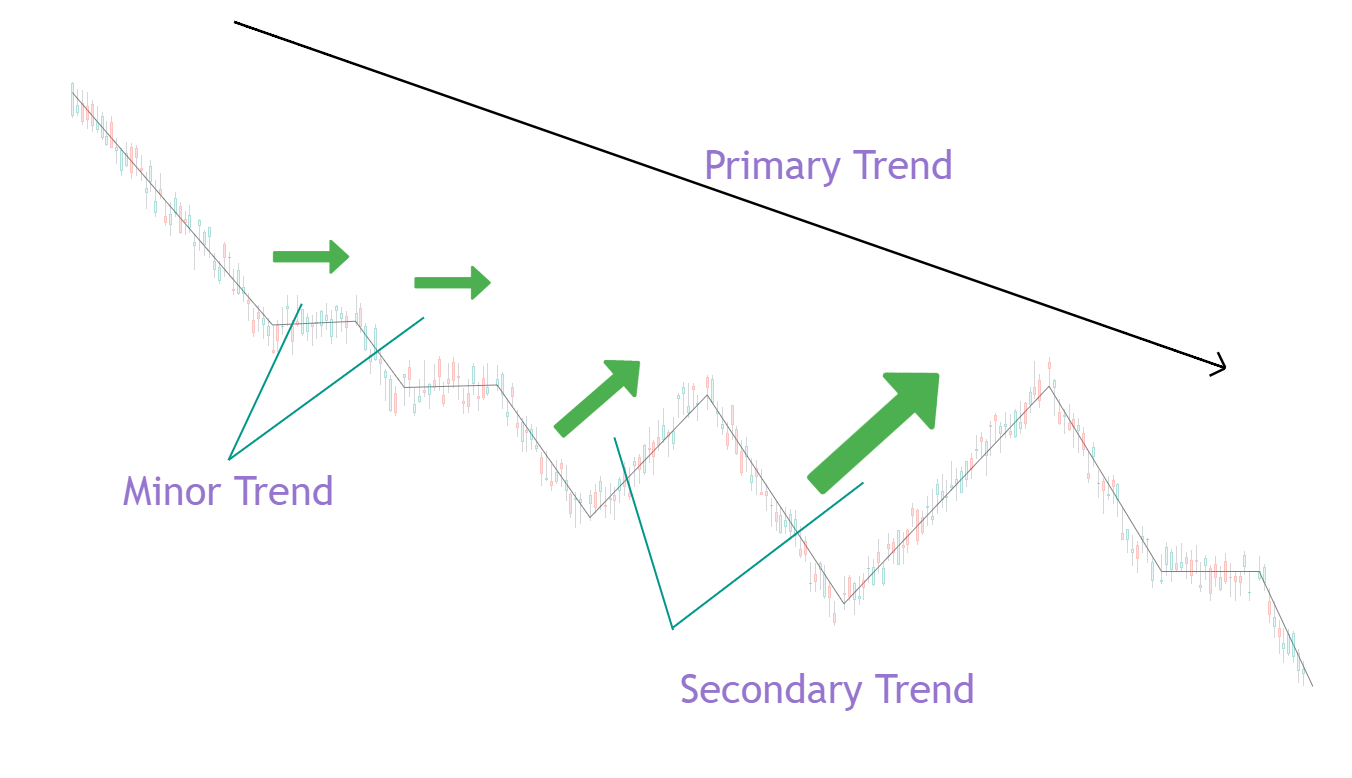

2) The market has 3 types of Trends:

The Primary Trend: It can be as long as years and is the ‘main movement’ of the market.

The Secondary Trend: lasting between 3 weeks to several months, retraces the last primary move by some 33-66% and is difficult to decipher.

The Minor Trend: is least reliable, lasting from several days to a few hours, constitutes noise in the market and may be subject to manipulation.

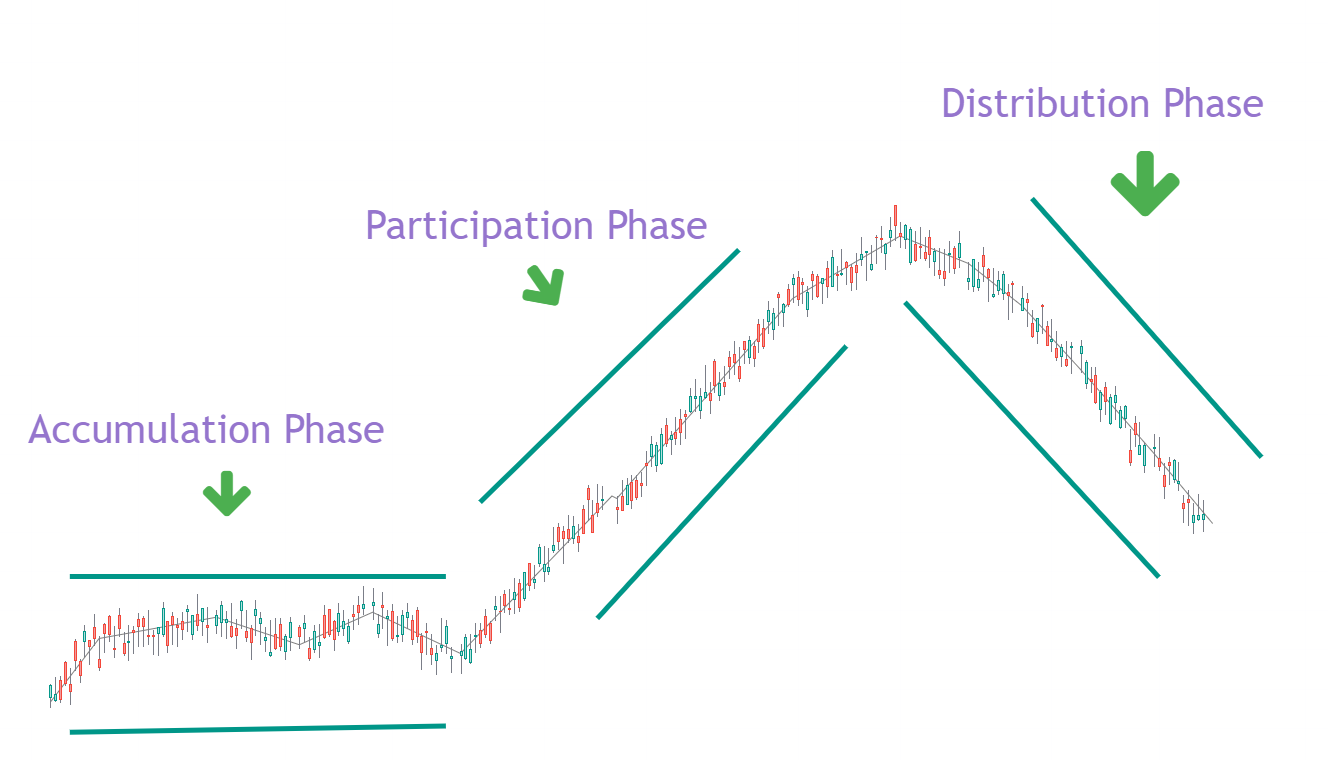

3) The market trend has 3 phases:

The beginning of a primary upward (or downward) trend in a bull (or bear) market is known as the accumulation phase. Here, Smart traders enter the market to buy (or sell) stocks against common market opinions.

The participation phase, more investors enter the market as business conditions improve and positive sentiments become evident. This results in higher (or lower) prices in the market.

The distribution phase is marked by excessive buying by inexperienced investors. This could result in great speculation. At this stage, it is ideal for investors to book profits and exit.

4) The averages must confirm each other:

Dow, referring to the DJIA and the Transport Index, meant that no important bull or bear market signal could take place unless both averages gave the same signal, thus confirming each other. He felt that both averages must exceed a previous secondary peak to confirm the inception or continuation of a bull market. He did not believe that the signals had to occur simultaneously but recognized that a shorter length of time between the two signals provided stronger confirmation. When the two averages diverged from one another, Dow assumed that the prior trend was still maintained

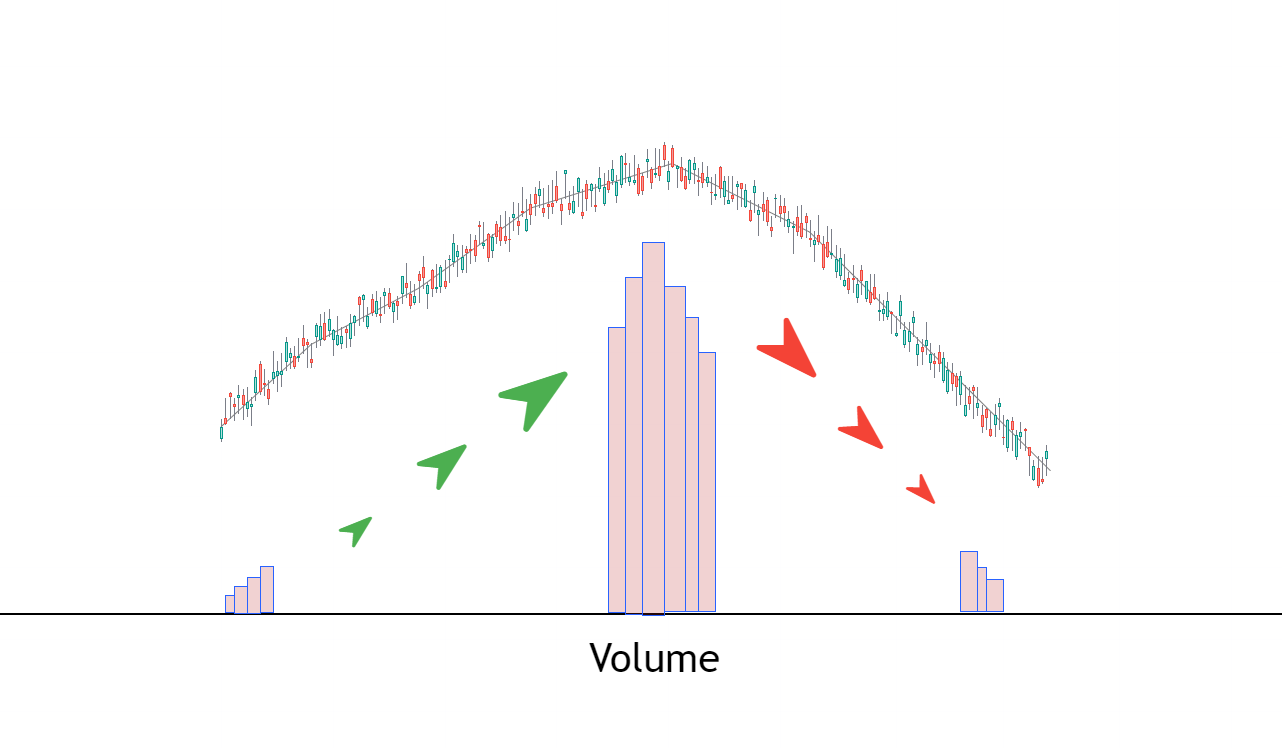

5) Volume must confirm the trend:

According to Dow's theory, the main signals for buying and selling are based on the price movements of the indexes. Volume is also used as a secondary indicator to help confirm what the price movement is suggesting

From this tenet, it follows that volume should increase when the price moves in the direction of the trend and decrease when the price moves in the opposite direction of the trend.

The reason for this is that the uptrend shows strength when volume increases because traders are more willing to buy an asset in the belief that the upward momentum will continue. Low volume during the corrective periods signals that most traders are not willing to close their positions because they believe the momentum of the primary trend will continue.

6) The trend will continue until an opposite force is applied:

An uptrend is defined by a series of higher highs and higher lows. In order for an uptrend to reverse, prices must have at least one lower high and one lower low (the reverse is true of a downtrend).

However, the longer a trend continues, the odds of the trend remaining intact become progressively smaller.

Now you know everything you need to understand the Dow Jones Theory. If you want to learn more about Trading and Investing make sure to register for an account on ATPrimer.

*All data provided is intended for educational or informational purposes only and should not be considered investment advice.