Rate Hike Countdown

Markets tumble ahead of Fed meeting next week

Equities get knocked down over mixed expectations on the Feds tightening and the start of the rate hike countdown. Chinese stocks have been losing steam as well after China cut its benchmark mortgage rates earlier this week.

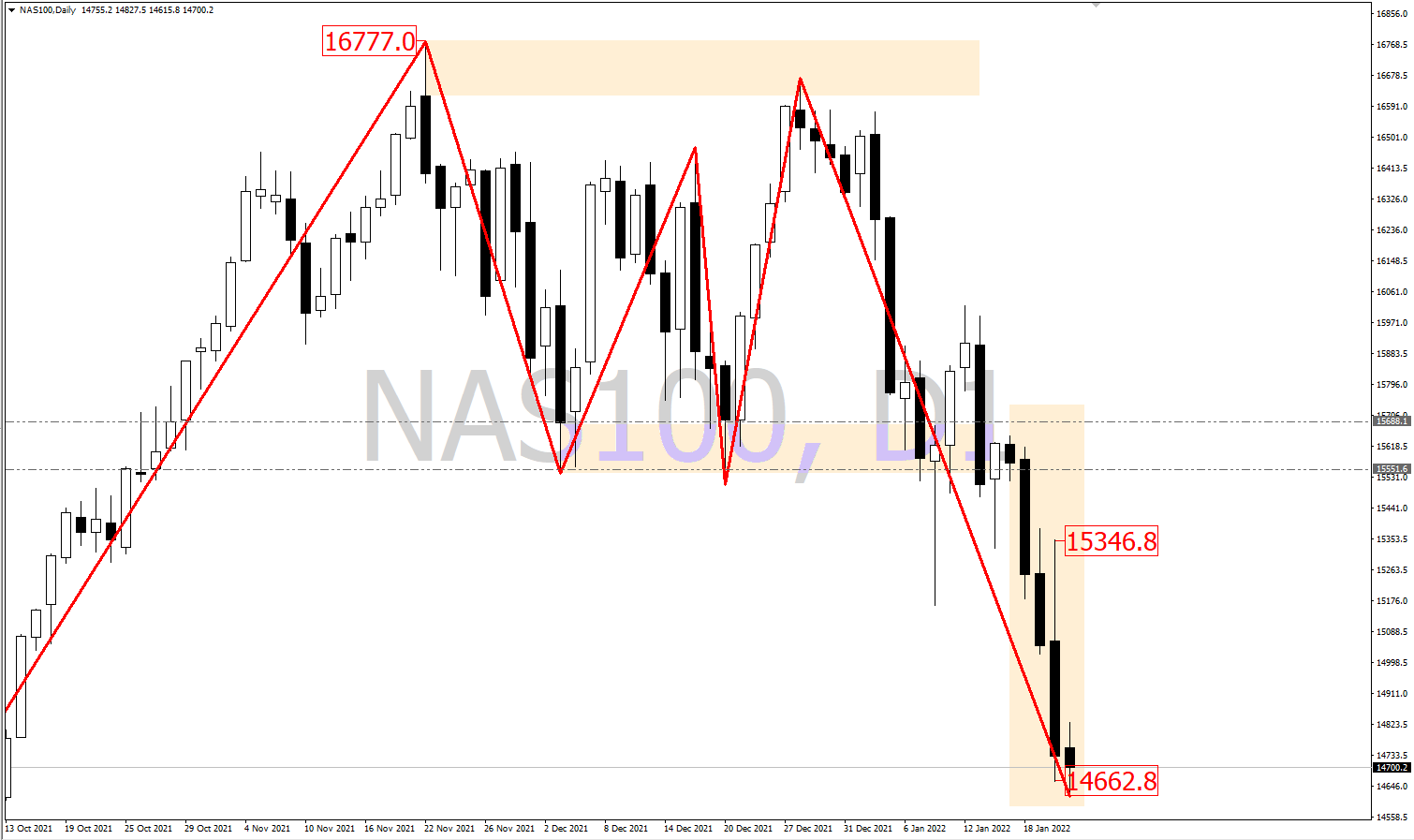

Meanwhile, the Nasdaq saw a sharp pull overnight due to investors' risk-averse sentiment and the continuation of what seems to be a clear correction. In addition to soaring inflation, an unstable labor market and Coronavirus imposed setbacks amid earnings season, hence another market rotation safe havens and value stocks.

Technically if the price starts to reverse gradually and goes back up to the resistance area highlighted at 15,551 and 15,688. Following the double bottom, another sell-off could occur.

Moreover, despite being a light week in terms of economic indicators, next week should get more interesting ahead of the Federal Reserve policy meeting on the 25th and 26th of January.

On a side note, Oil prices have also been under the spotlight as they wobble next to 7-year highs. Supported by drawbacks in crude oil inventories, geopolitical tensions, and the outage of the pipeline from Iraq to Turkey. Brent approached levels of $89 at $88.79 while WTI rose to $86.90. Goldman Sachs has also raised its oil price forecasts significantly for 2023 at $105 per barrel and $96 for 2022.