Risk Appetite Under Pressure

Geopolitical tensions and the Fed rate hike remain under the spotlight in major markets, stirring markets. Whilst Asian markets settle lower following a Wallstreet drop for the 3rd consecutive session. And though there had been no invasion as of yet, markets hold their breath on the implications of the wide possibility of Russian invasion on Ukraine.

In addition to the European tensions and oil shooting for the stars, investors are also weighing in the different routes the Federal Reserve could take with the options being a 50-basis point increase whilst other investors start to price in more than 5 rate hikes till the end of the year.

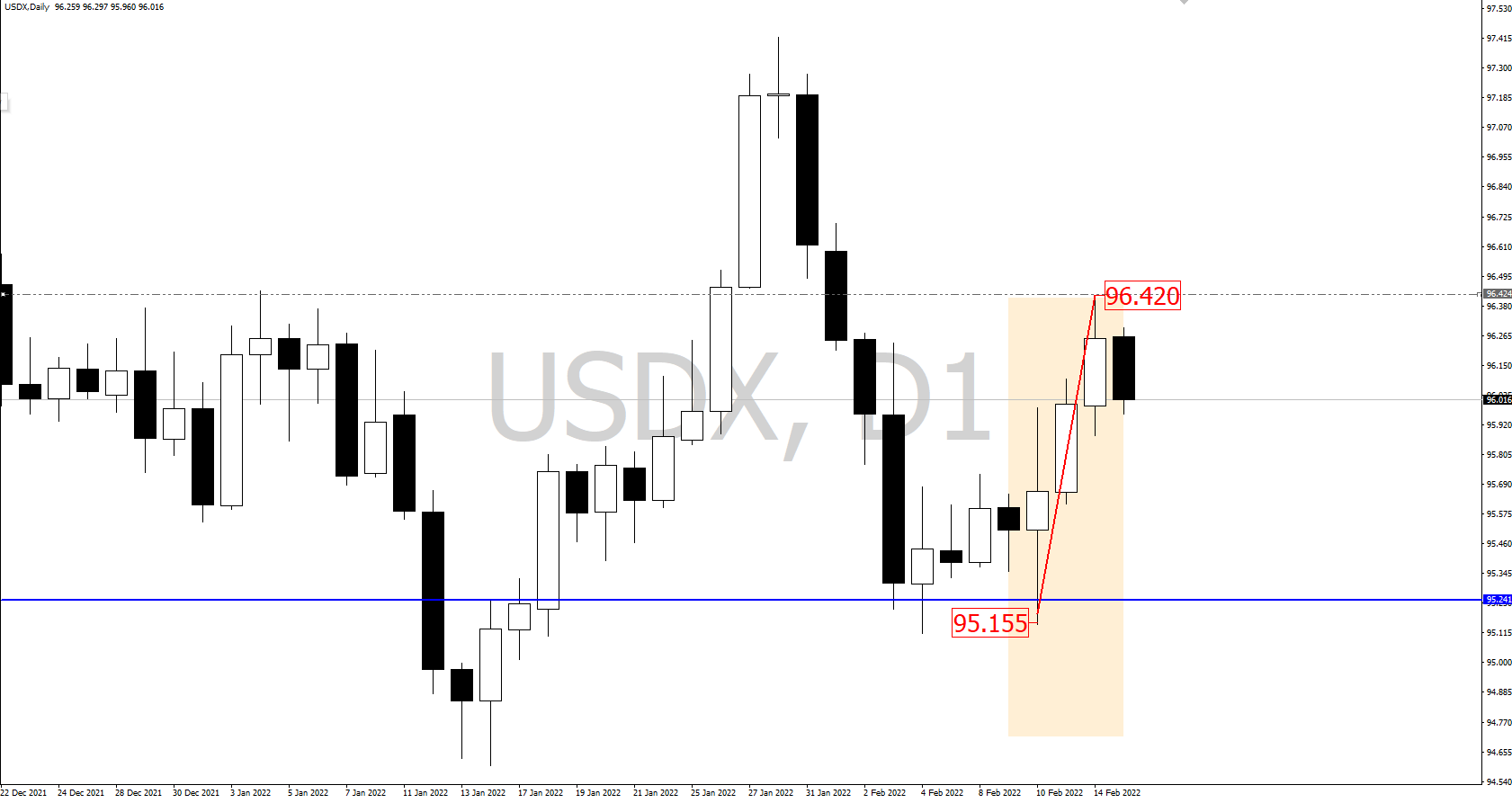

As a countereffect, the USD hit its 2-week high overnight especially after the hawkish comments from St. Louis Federal Reserve President James Bullard calling for faster U.S. Federal rate hikes after calling for a 50 basis point increase last week. On the same note, the Bank of Japan also in a statement said it will not frequently buy bond government bonds keeping investors more on edge.

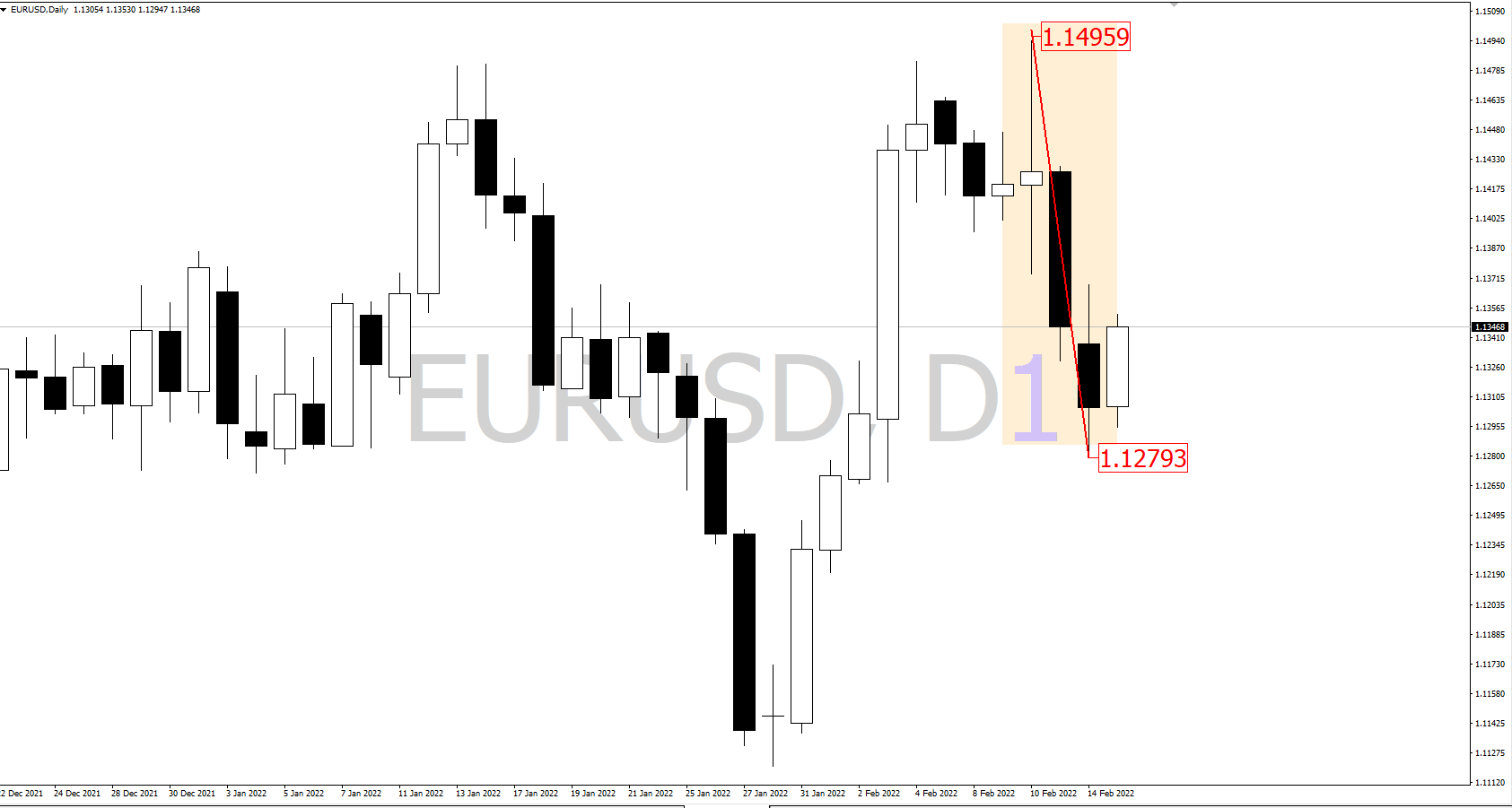

Meanwhile, safe-haven assets were allocated most of the liquidity in the markets, the Euro continued with its sharp losses overnight over the Eastern Europe situation while also losing ground to the USD as the greenback reverses its trend on a more aggressive rate hike stance.

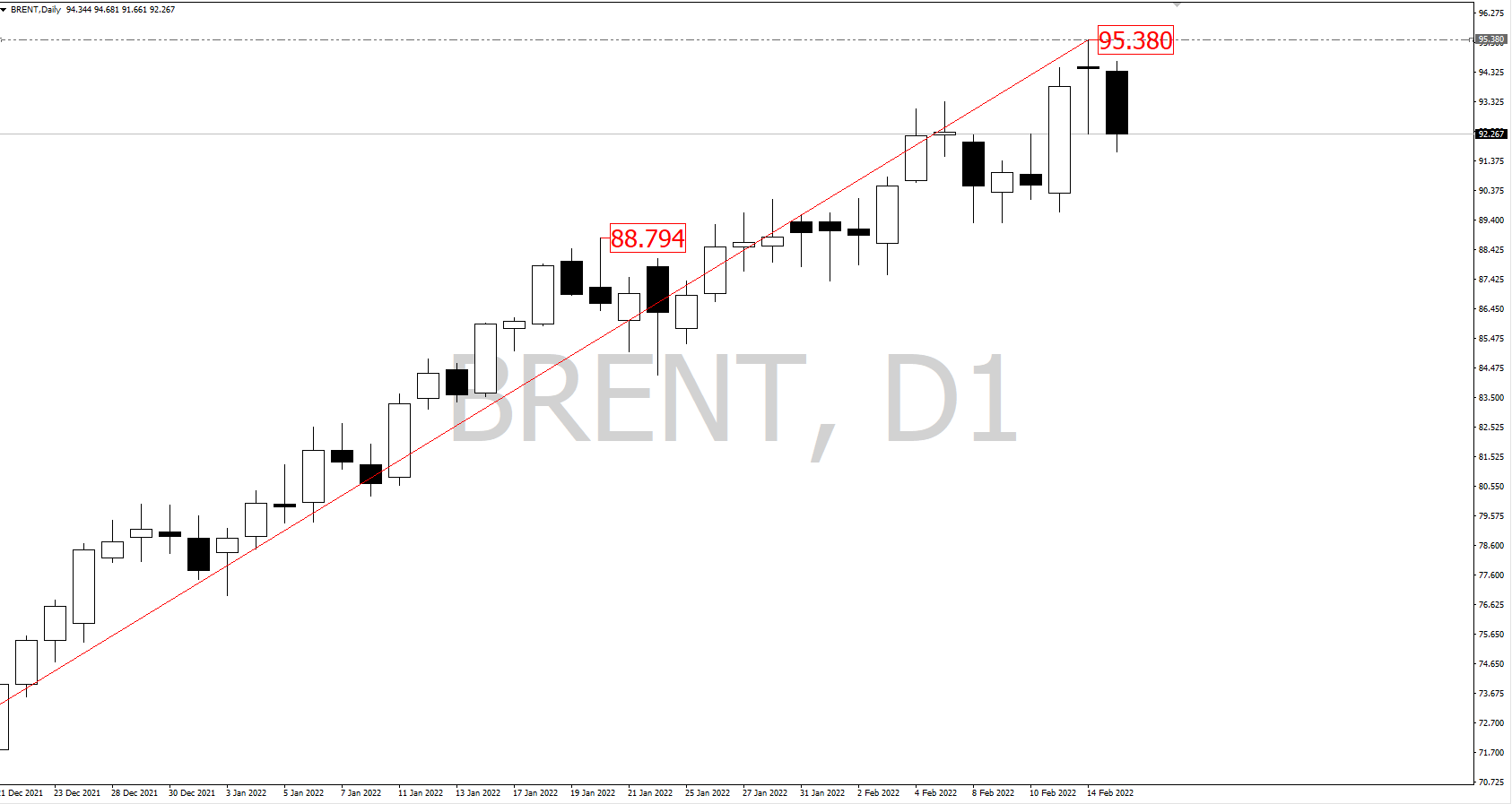

In Commodities, Oil continued to head towards its 7-year highs unlocking $95.38 for Brent and $94 for WTI.

In Commodities, Oil continued to head towards its 7-year highs unlocking $95.38 for Brent and $94 for WTI.