Financial markets await US inflation data

Today, markets are waiting for the release of The Consumer Price Index (CPI) report.

- U.S. consumer prices are expected to have risen at a slower pace in July, but that is not expected to stop the Federal Reserve from at least several more sharp interest rate hikes which could curb economic activity.

- The July U.S. consumer price index is forecast to come in at 8.7%, down from the soaring level of 9.1% hit in the previous month. A decline may be seen as an early sign that inflation has peaked, even though prices would remain near their highest level in four decades.

- Such a decrease is unlikely to change the narrative for the Federal Reserve, which has been aggressive in hiking interest rates in a bid to bring down surging inflation. The Fed has said that it will take several months of falls in CPI growth before it pumps the brakes on rate tightening.

Equities:

In Wall Street, stocks were mostly flat as investors awaited data that could influence the Federal Reserve’s tightening path. The Nasdaq closed lower on after a bleak outlook from technology company “Micron” sent shares of technology and chip makers lower.

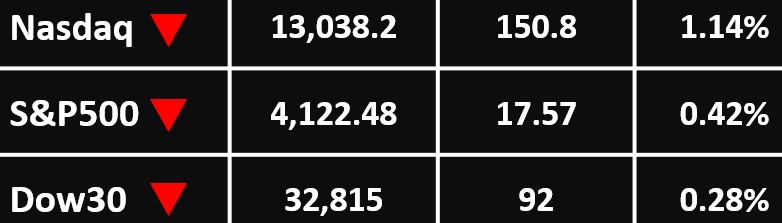

The Dow Jones Industrial Average fell 0.28% to close at 32,815 points, while the S&P 500 lost 0.42% at 4,122.48 points and the Nasdaq Composite fell 1.14% to 13,038.2 points.

----------------------------------------

Currency Market:

Major currencies held steady with traders cautious about placing large bets ahead of U.S. inflation data, which markets will scrutinize for guidance on how steeply the U.S. Federal Reserve will raise interest rates in coming months.

The US Dollar Index was trading down only marginally by 0.04% at 106.33.

AUD/USD trades around 0.6950 while USD/CAD hovers around 1.2890. The NZD/USD was flat at $0.6284. Japan's yen moved down 0.08% to JPY 135.03.

GBP/USD eased and trades at around 1.2060. The EUR/USD was broadly unchanged with the common currency changing hands at $1.0208.

----------------------------------------

Commodities: Gold

Gold prices were steady as safe haven demand rose ahead of key U.S. inflation data. Buying into the yellow metal has been supported this week by anticipation of U.S. CPI inflation data.

Spot gold prices hovered around $1,793.99 an ounce, while gold futures fell 0.1% to $1,809.95.

----------------------------------------

Commodities: Oil

Oil prices fell ahead of a key U.S. report on inflation and after industry data showed U.S. crude inventories unexpectedly rose last week, signaling a potential hiccup in demand.

Brent crude futures fell 74 cents, or 0.8%, to $95.57 a barrel. U.S. West Texas Intermediate crude futures fell as much as $1.13 to $89.37. It was last down 88 cents, or 1%, at $89.62 a barrel.

ـــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ

For more articles click here