Global Markets: General Sentiment (Sep. 30th, 2022)

Investors expect that the Fed’s commitment to keep hiking rates, which was reiterated by several officials this week, will keep markets into red zone for the remainder of the year.

- The U.S. dollar has been in demand of late, climbing to 20-year highs, as Fed policymakers point to further rate hikes to curb inflation at historic highs.

- The euro remained pressured, however, by the difficult geopolitical situation, with the region suffering from an energy crisis as Russia’s war in Ukraine continues.

- Data showed the number of Americans filing new claims for unemployment benefits fell to a five-month low last week as the labor market remains resilient despite the Fed's aggressive interest rate hikes.

---------------------------------

Equities:

- Wall Street ended sharply lower on Thursday on worries that the Federal Reserve's aggressive fight against inflation could hobble the U.S. economy, and as investors fretted about a rout in global currency and debt markets.

- All 11 S&P 500 sector indexes declined, led lower by utilities, down 4.06%, followed by a 3.37% loss in consumer discretionary. The S&P 500 posted no new highs and 106 new lows; the Nasdaq recorded 14 new highs and 518 new lows.

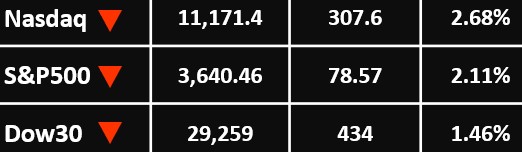

- The Nasdaq declined 2.68% to 11,171.4 points, while the S&P 500 dropped 2.11% to end the session at 3,640.46 points. Dow Jones Industrial Average declined 1.46% to 29,259 points.

---------------------------------

Currency Market:

- The U.S. dollar edged lower in early European trading. The Dollar Index fell 0.3% to 111.903 close to the one-week low of 111.64 reached in the previous session.

- EUR/USD edged higher to 0.9817 as French inflation showed some sign of moderation, falling 0.5% on the month in September. GBP/USD traded 0.3% higher at 1.1157 having earlier climbed above 1.12 in the Asian session, taking it very close to erasing all of the sharp losses in the aftermath of the new government's unfunded tax-cutting mini budget last week.

- USD/JPY fell slightly to 144.32, trading largely sideways below the psychologically important 145. AUD/USD rose 0.1% to 0.6503, while USD/CNY slipped 0.5% to 7.0900.

---------------------------------

Commodities: Gold:

- Gold prices rose slightly as pressure from the dollar eased further, but were set for a sixth straight month of losses as rising interest rates severely dampened the outlook for the yellow metal.

- Spot gold prices rose 0.2% to $1,674.23 an ounce, while gold futures were up 0.2% at $1,671.20 an ounce.

---------------------------------

Commodities: Oil:

- Oil prices were little changed during Asian trade on Friday, though headed for their first weekly gain in five weeks, underpinned by a weaker U.S. dollar and the possibility that OPEC+ may agree to cut crude output when it meets on Oct. 5.

- Brent crude inched down 0.15% to $88.36 a barrel, while WTI crude futures rose 0.06% to $81.28 a barrel.

---------------------------------------

For more articles click here