Investors Turned Their Focus to Inflation and NFP Data

Investors turned their focus to inflation data and this week's U.S. labor market report to gauge if interest rate hikes that have been priced in around the world are justified.

Inflation is near double-digit territory in many of the world's biggest economies, a level not seen in close to a half century, which could prompt central banks in the United States and Europe to resort to more aggressive interest rate hikes.

U.S. non-farm payrolls data is due on Friday, and markets may not like a strong number if it supports the basis for a continuation of aggressive interest rate hikes.

---------------------------------------------------

Equities:

- In Wall Street, U.S. stocks closed lower on Monday, adding to last week's sharp losses on nagging concerns about the Federal Reserve's determination to aggressively hike interest rates to fight inflation even as the economy slows.

- Growth stocks such as Apple Inc (AAPL.) off 1.37%, and Microsoft Corp MSFT.O down 1.07% were among the biggest drags on the index as Treasury yields rose.

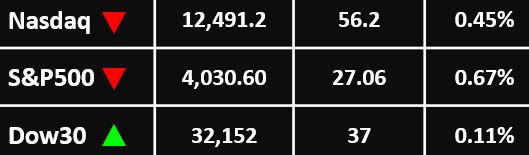

- The Nasdaq Composite dropped 56.2 points or 0.45% to 12,491.2. The S&P 500 lost 27.06 points or 0.67% to 4,030.60, while the Dow Jones Industrial Average added just 37 points or 0.11% to 32,152 points.

---------------------------------------------------

Currency Market:

- The U.S. dollar edged lower, falling back from a 20-year peak. The Dollar Index traded 0.1% lower at 108.733, after dropping back from 109.48 overnight, a level not seen since September 2002.

- EUR/USD edged higher to 0.9997, after rallying 0.3% on Monday, its biggest rise in almost three weeks.

- GBP/USD rose 0.1% to 1.1721, recovering from an almost 2-1/2-year low of 1.1649 reached on Monday.

- USD/JPY fell 0.2% to 138.49, after rising to 139 overnight for the first time since mid-July, while the risk-sensitive AUD/USD rose 0.1% to 0.6912.USD/CNY rose 0.1% to 6.9149.

---------------------------------------------------

Commodities: Gold

- Gold prices recovered slightly, taking some relief as the dollar retreated from a 20-year peak, although hawkish signals from the Federal Reserve still weighed on the market.

- Spot gold rose 0.1% to $1,737.85 an ounce, while gold futures broke above $1,750 an ounce.

---------------------------------------------------

Commodities: Oil

- Oil prices dipped, paring some gains from the previous session, as the market feared that more aggressive interest rates hikes from central banks may lead to a global economic slowdown and soften fuel demand.

- Brent crude futures dropped 56 cents, or 0.5%, to $104.53 a barrel. WTI crude was at $96.86 a barrel, down 14 cents, or 0.1%.

---------------------------------------------------

For more articles click here