Markets remain divided on FOMC'S decision on interest rates

Markets remain divided on whether the Fed will hike rates by 50 or 75 basis points at its September meeting. The Fed’s main monetary policy tool, the Federal Funds rate, rose from near zero to its current target range of 2.25% to 2.50% in early March, and more hikes are sure to follow, but the sustained pace and final stopping point are still unclear for investors.

- The U.S. dollar climbed to fresh highs, with Federal Reserve policymakers retaining a hawkish stance over monetary policy ahead of the central bank's key Jackson Hole symposium later this week.

- Jerome Powell will speak Friday morning at Jackson Hole symposium. The meeting provides a focus for a Fed chief or other policymaker to fine-tune their reporting. Powell is expected to remain fully focused on that battle and its unique commitment. from the Fed to win it. The ears of the world will linger on every word.

Equities:

- In Wall Street, US stocks fell on Friday amid a broad-based sell-off led by major companies as US bond yields rose, while the S&P 500 index posted a weekly loss after a four-week winning streak. The shares of Amazon, Apple and Microsoft declined and were among the biggest decliners on the S&P and Nasdaq indices.

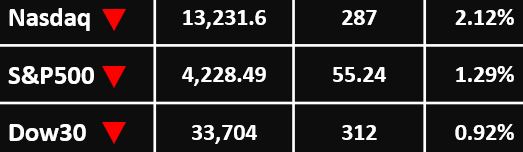

- The Dow Jones Industrial Average lost 312 points, or 0.92% to 33,704 points. S&P 500 index fell 55.24 points or 1.29% to 4,228.49 points, and the Nasdaq Composite Index fell 287 points or 2.12% to 13,231.6 points.

---------------------------------------------------

Currency Market:

The Dollar Index traded 0.1% higher to 108.160, after climbing earlier Monday as high as 108.26 for the first time since July 15. The index gained over 2% last week, its best weekly rally since April 2020, boosted by a series of Fed officials stressing that more hefty interest rate hikes are needed to combat inflation soaring at 40-year highs.

EUR/USD fell 0.1% to 1.0027, GBP/USD edged lower to 1.1824, USD/JPY rose 0.1% to 137.03, with the yen hurt by a spike in Treasury yields ahead of the Jackson Hole symposium. USD/CNY rose 0.1% to 6.8271, while the risk-sensitive AUD/USD rose 0.4% to 0.6898.

---------------------------------------------------

Commodities: Gold

- Gold prices slipped further as uncertainty over the Federal Reserve’s path of monetary tightening persisted. Prices had retreated last week as hawkish comments from several Fed officials suggested that the central bank was likely to commit to raising interest rates at a sharp clip to combat overheated inflation.

- Spot gold prices fell 0.1% to $1,738.21 an ounce, while Gold futures dropped 0.2% to $1,759.90 an ounce

---------------------------------------------------

Commodities: Oil

- Oil prices slumped, ending three days of gains, as investors were concerned aggressive U.S. interest rate hikes will weaken the global economy and dent fuel demand while a strengthening dollar also added to pressure.

- Brent crude futures declined $1.58, or 1.6%, to $95.14 a barrel, while WTI crude futures were down $1.70, or 1.9%, at $89.07 a barrel.

---------------------------------------------------

For more articles click here