Post-Easter Market Update

Wall Street session ends in the red territory by a small percentage and continues to seesaw in the Asian session this morning, following positive earnings from Bank of America, Dollar strength, the resurgence of oil prices, and the latest PBOC statements that reflect supporting the economy.

The Dow saw intense volatility only to close lower by a negative 0.11%, Tech and Energy were amongst the top-performing sectors in the session, despite investors heavily weighing higher interest rates on growth stocks especially after Fed official James Bullard's speech yesterday pushing for a 75bp hike. Although it didn’t dramatically affect markets as a 50bp was already on the table.

In the Commodity market, Brent and WTI both gained over political tensions in Libya as they shut fields due to pollical protests denting rising supply worries. With Brent almost hitting $114 and WTI also rising to $109.12. Oil has been on a winning streak for the past 4 consecutive trading sessions however appearing to be very vulnerable to demand concerns, slipping nearly 1.5% as shanghai prepares to re-open following its shutdown.

On the same disruptive note, the world bank has also lowered its global growth forecast by nearly a full percentage from 4.1% to 3.2% with reference to the Russia, Ukraine war and the impact it had on the EU as a whole. Investors have been wary of a recession ultimately that’s why markets have been witnessing increased day-to-day fluctuations without a steady sentiment.

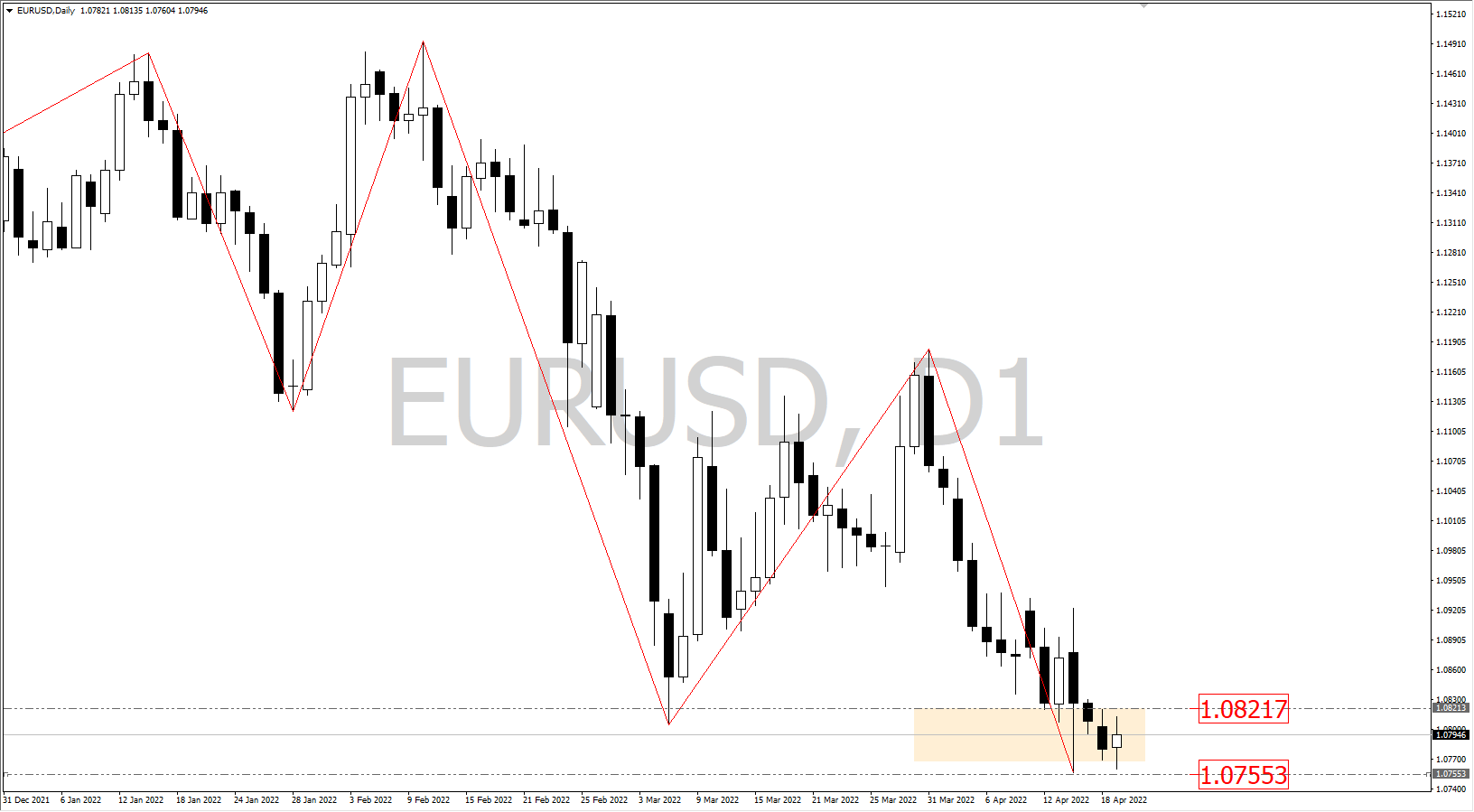

To conclude, in the currency market, the Euro recovered some ground from its 2-year low of $1.075 residing back to $1.080, granted it has been a tough level of resistance with the dollar climbing past 101 for the first time in two years.