Traders' eyes are on the Jackson Hole Symposium

Investors are now focused on the Jackson Hole symposium that begins on Thursday, with remarks from Fed Chair Jerome Powell on Friday potentially providing clues about the pace of future rate hikes and whether the central bank can achieve a “soft landing” for the economy.

- Traders are divided between expecting a 50-basis point hike and a 75-basis point hike by the US central bank.

- Market attention also is on the minutes due on Thursday from the European Central Bank's last policy meeting that are likely to sound hawkish.

- The ECB hiked interest rates by a bigger than expected 50 basis points last month to zero percent and economists expect no letup by the central bank as it seeks to stamp out runaway inflation.

---------------------------------------------------

Equities:

- Wall Street ended higher on Wednesday, lifted by gains in energy stocks and Intuit while investors awaited the US Federal Reserve’s Jackson Hole conference this week.

- All 11 S&P 500 sector indexes rose, led by energy, up 1.2%, followed by a 0.71% gain in real estate. Boosting the tech-heavy Nasdaq, Intuit Inc. rallied almost 4% after the accounting software maker forecast upbeat fiscal 2023 revenue.

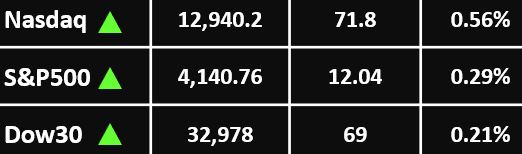

- The Nasdaq gained 0.41% to 12,431.53 points, The S&P 500 climbed 0.29% to end the session at 4,140.77 points, while the Dow Jones Industrial Average rose 0.18% to 32,969.23 points.

---------------------------------------------------

Currency Market:

- The U.S. dollar eased lower, but remained near a two-decade high ahead of the start of the Federal Reserve’s Jackson Hole gathering as traders look for more cues on monetary policy. The Dollar Index, traded 0.5% lower to 108.062, still close to its highest level since September 2002 at 109.29 reached in mid-July.

- EUR/USD rose 0.5% to 1.0020, climbing back above parity after the German economy grew in the second quarter, beating expectations for no growth. GBP/USD rose 0.5% to 1.1852, bouncing from the lowest level since March 2020 of 1.1718 as the country faces a prolonged slowdown.

- USD/JPY fell 0.4% to 136.60, USD/CNY fell 0.2% to 6.8474, while the risk-sensitive AUD/USD rose 1% to 0.6975.

---------------------------------------------------

Commodities: Gold

- Gold prices moved little, but held on to recent gains as traders awaited more cues on U.S. monetary policy.

- Spot gold rose to $1,763 an ounce, while gold futures rose to $1,765.0 an ounce.

---------------------------------------------------

Commodities: Oil

- Oil prices rose on mounting supply tightness concerns amid disruptions to Russian exports, the potential for major producers to cut output, and the partial shutdown of a U.S. refinery.

- Brent crude rose 45 cents, or 0.4%, to $101.67 a barrel, while WTO was up 32 cents, or 0.3%, at $95.21 a barrel.

---------------------------------------------------

For more articles click here