Global Markets: General Sentiment (October 3rd, 2022)

This week, investors will be looking closely at Friday’s U.S. jobs report to assess how much impact the Federal Reserve’s rate hikes are having on the economy. Several Fed officials are also due to speak during the week, as markets try to gauge their appetite for another 75 basis-point rate hike at the bank’s November meeting.

- Fears are growing among investors as interest rate hikes could slow economic growth, coupled with a brewing financial crisis in Europe and the UK.

- Many investors believe the wild moves will continue until there is evidence that the Fed is winning its battle against inflation, allowing policymakers to eventually end monetary tightening.

- The main data release due Monday will be the latest German manufacturing PMI number, which is expected to show this sector of the Eurozone’s economic powerhouse had contracted further in September.

---------------------------------

Equities:

- Wall Street has posted three quarterly declines in a row, the longest losing streak for the S&P 500 and the Nasdaq since 2008 and the Dow's longest quarterly slump in seven years. Among the 11 major sectors of the S&P 500, real estate was the sole gainer, while utilities tech suffered the largest percentage losses.

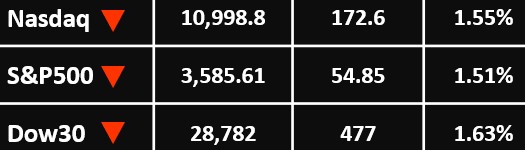

- The Nasdaq Composite dropped 172.6 points or 1.55%, to 10,998.8. The S&P 500 lost 54.85 points or 1.51%, to 3,585.61. The Dow Jones Industrial Average fell 477 points or 1.63%, to 28,782.

---------------------------------

Currency Market:

- The Dollar Index edged higher to 112.13, close to the one-week low of 111.64 seen late last week.

- EUR/USD fell 0.1% to 0.9796, after an escalation of the region’s energy crisis, with Russian energy Gazprom freezing its gas flows to Italy over the weekend.

- GBP/USD climbed 0.3% to 1.1188 .

- USD/JPY rose 0.1% to 144.95, just under the psychologically-important 145 line which could prompt Japanese officials to step in again after they conducted their first yen buying intervention since 1998 last month.

- AUD/USD rose 0.5% to 0.6436 and NZD/USD climbed 0.9% to 0.5643.

---------------------------------

Commodities: Gold:

- Gold prices steadied above a major support level on Monday as growing risks of an economic recession spurred some demand for the yellow metal (The safe haven).

- Spot gold rose 0.2% to $1,663.99 an ounce, while gold futures were flat around $1,672 an ounce.

---------------------------------

Commodities: Oil:

- Oil prices jumped more than 3% in early Asian trade on Monday, as OPEC+ considers cutting output by more than 1 million barrels a day, for its biggest reduction since the pandemic, in a bid to support the market.

- Brent crude futures rebounded 2.8% to $87.50 a barrel. WTI crude was up 2.9% at $81.76 a barrel.

---------------------------------------

For more articles click here