Markets face volatility ahead of the Jackson Hole Symposium

Investors are anticipating what could be a volatile week of trading ahead of Fed Chair Jerome Powell’s latest comments on inflation at the central bank’s annual Jackson Hole economic symposium. The market is dropping down as several voices assert that the Fed has to be more aggressive to slow the economy down further to bring inflation back down.

- Ahead of Jackson Hole the dollar is going to remain relatively firm, even though it’s overextended. Fed funds futures are now pricing in a 54.5% chance of a 75 basis-point hike by the Fed in September, instead of the greater probability of a 50 basis-point hike as the market had expected going into the weekend.

- This hawkish turn of sentiment follows several Fed officials suggesting during last week that the central bank will likely not reduce its pace of rate hikes until inflation is comfortably within its target.

---------------------------------------------------

Equities:

- U.S. shares fell sharply as fears mounted that central bank efforts to tame rising consumer prices with inflation-busting interest-rate hikes will weaken the global economy and lead to a recession. Tech stocks declined and Amazon fell 3.6%. Semiconductor stocks dropped with Nvidia down about 4.6%. Shares of Netflix were roughly 6.1% lower.

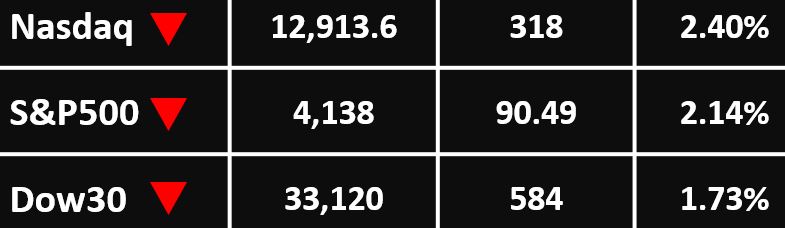

- The Dow Jones Industrial Index sharply fell, in its worst day since June, 584 points, or 1.73% to 33,120 points. S&P 500 index fell 90.49 points or 2.14% to 4,138 points, and the Nasdaq Composite Index fell 318 points or 2.40% to 12,913.6 points.

---------------------------------------------------

Currency Market:

- The U.S. dollar pushed higher ahead of the central bank's key Jackson Hole symposium later this week, while the euro fell to two-decade lows as Europe’s energy woes deepened.

- The Dollar Index traded 0.1% higher to 109.108, not far from the two-decade high of 109.29 hit in July.

- EUR/USD fell 0.3% to 0.9911, dropping below parity to its lowest level since late 2002 as Europe struggles with energy supply and slowing growth concerns.

GBP/USD dropped 0.3% to 1.1730, USD/JPY fell 0.2% to 137.16, AUD/USD fell 0.1% to 0.6866, while USD/CNY rose 0.2% to 6.8632.

---------------------------------------------------

Commodities: Gold

- Gold prices rose slightly after seven straight sessions of losses, but remained under pressure as growing expectations of a hawkish Federal Reserve boosted the dollar and treasury yields.

- Spot gold rose 0.1% to $1,742.12 an ounce, while gold futures rose 0.2% to $1,751.55 an ounce.

---------------------------------------------------

Commodities: Oil

- Oil rose as renewed concerns over tight supply dominated market sentiment after Saudi Arabia warned that the major oil producer could cut output to correct a recent black gold price decline.

- Brent crude gained 42 cents, or 0.4%, to $96.90 a barrel. WTI crude futures rose 40 cents, or 0.4%, to $90.76 a barrel.

---------------------------------------------------

For more articles click here