Producer Price Index showed a surprise decline

Investors received better economic news when the July producer price index showed a surprise decline from June. PPI dropped 0.5%, compared with an estimate of a 0.2% gain. The PPI reading excluding food and energy rose less than expected.

- Markets were tentative this week ahead of key economic data out of the United States. The consumer price index (CPI) report on Wednesday showed inflation was slightly lower than expected in July, while the producer price index (PPI) unexpectedly fell for the first time since April 2020.

- The slight easing of inflation readings had driven global stocks higher and capped a rising dollar, until a string of Fed speakers put paid to expectations of the central bank going slow on further policy tightening.

Equities:

- In Wall Street, US Stocks struggled for direction as investors mulled another better-than-expected inflation report.

- Stocks rallied after Wednesday’s report and again Thursday morning, but the uptrend waned later in the day. Some stock market bulls are watching a technical indicator for clues on whether a summer rebound in U.S. equities will roll on.

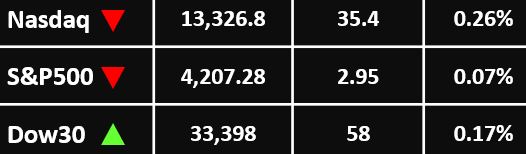

- The three major indices opened yesterday session higher but lost steam as the day progressed. The S&P 500 closed down less than 0.1%, while the Nasdaq Composite slumped 0.26%. The Dow nudged upward by 58 points or 0.17%.

--------------------------------------------

Currency Market:

- The Dollar Index traded 0.1% higher at 105.045, but still significantly lower than last Friday’s peak of 106.93.

- USD/JPY climbing 0.3% to 133.36 as U.S. Treasury yields bounced off their recent lows. GBP/USD fell 0.1% to 1.2203 after data showed that the U.K. economy shrank in the second quarter for the first time in five quarters, but by a fraction less than expected.

- EUR/USD traded largely flat at 1.0316, with the single currency struggling to make any gains given the difficulties the Eurozone’s economy is having to battle. The AUD/USD pair hovers around 0.7100, while USD/CAD trades at around 1.2770.

--------------------------------------------

Commodities: Gold

- Gold prices retreated on Friday, as hawkish comments on interest rate hikes by the Federal Reserve outweighed optimism over signs of cooling U.S. inflation.

- Spot gold was down 0.1% at $1,788.13 an ounce, while gold futures held around $1,803.50. Still, both instruments were set for mild gains this week, marked by a sharp fall in the dollar.

--------------------------------------------

Commodities: Oil

- Oil prices inched higher on Friday, with benchmark contracts headed for a weekly climb as recession fears eased, though an uncertain demand outlook capped gains. OPEC cut its forecast for growth in world oil demand in 2022 by 260,000 bpd. It now expects demand to rise by 3.1 million bpd this year.

- Brent crude futures rose 23 cents, or 0.2%, to $99.83 a barrel, while WTI crude futures climbed 3 cents to $94.37 a barrel.

ـــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ

For more articles click here