U.S. Inflation Slowdown Revives Gold and Equity Markets

July’s CPI in the United States contracted more than anticipated, down to 8.5% YoY from 9.1% in June. The slowdown in inflation was the first “positive” indication of price pressure since the Fed began tightening policy.

But the Federal policy makers does not expect the Fed is finished with rate increases and that they expect the funds rate to top out at 4%. They also expect rates to rise this year and next. The idea of cutting interest rates early next year is unrealistic but the country may enter into a recession in the near future.

Inflation at 8.5% is still very high, but there is optimism that June may have been the peak. The inflation reading during the months of July, August and September will show the severity of the US Federal Reserve to raise interest rates during the coming period.

Equities:

- Wall Street rallied on Wednesday, sending the Nasdaq more than 20% above its June low after U.S. Inflation slowed more than expected in July, fueling hopes that the Federal Reserve will become less aggressive about raising interest rates.

- The Wall Street rally was massive, with all 11 sectors of the S&P 500 rising in a sea of green. Growth stocks rose more than value, while Dow transportation companies, small caps and semiconductors also gained.

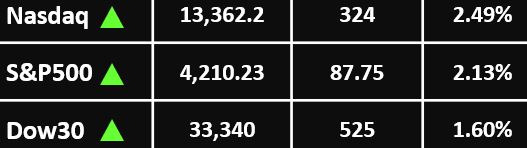

- The Dow Jones Industrial Average rose 525 points or 1.60%, to 33,340, while the S&P 500 added 87.75 points or 2.13% , to 4,210.23 points, while the Nasdaq Composite added 324 points or 2.49% up to 13,362.2.

--------------------------------------------

Currency Market:

- The US dollar made up some losses on Thursday after a steep drop the previous day on softer than expected inflation data out of the U.S.

- The dollar index was trading 0.08% higher at 105.28.

- The EUR/USD pulled back slightly from its largest daily percentage gain since mid-June, with the European common currency now changing hands up 0.16% at $1.0313.

- The Japanese yen was down 0.11% against the dollar at 132.70, after a 1.6% fall on Wednesday. Elsewhere, the AUD/USD edged higher by 0.27% to $0.71, while GBP/USD held mostly steady at $1.22.

--------------------------------------------

Commodities: Gold

- Gold prices had rallied to a one-month high on Wednesday after data showed that U.S. inflationary pressures eased in July, which dented the dollar. But they had shortly retreated from their peak, as the data triggered a widespread rally in risk-driven assets.

- Spot gold fell 0.1% to $1,789.91, while gold futures were down 0.5% at $1,805.45.

--------------------------------------------

Commodities: Oil

- Oil prices drifted lower on Thursday after gaining more than $1 in the previous session, as concerns over supply disruptions eased and markets looked for evidence of improving fuel demand.

- Brent crude futures dipped 7 cents, or 0.1%, to $97.33 a barrel, while U.S. West Texas Intermediate crude futures fell 9 cents, or 0.1%, to $91.85.

ـــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ

For more articles click here